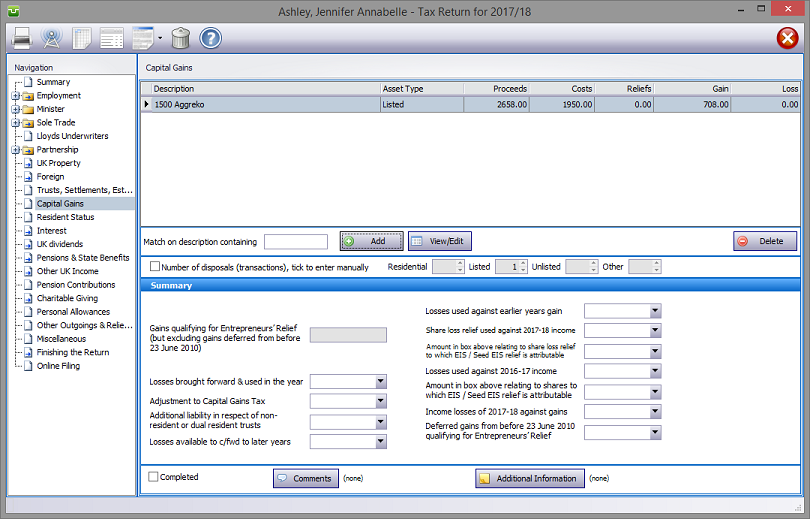

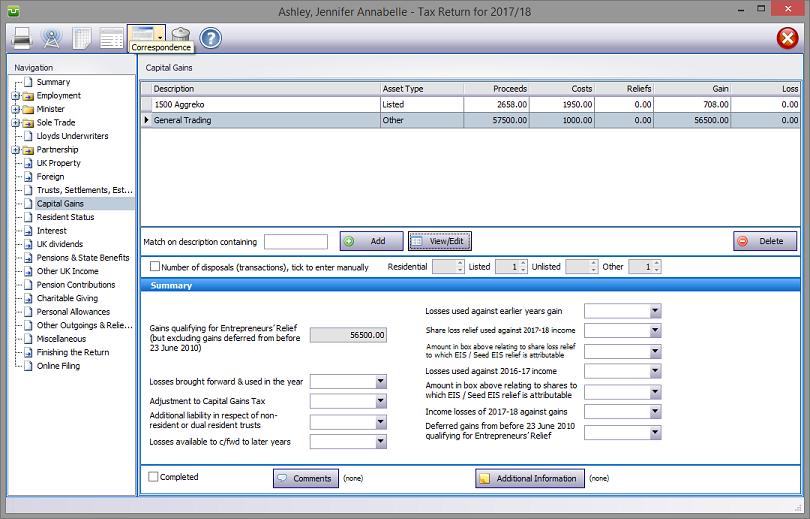

In the Navigation pane click on Capital Gains

Please read the HMRC document sa108-notes.

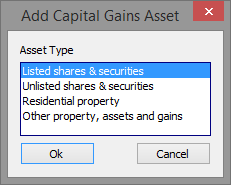

Next click on the Add button.

Capital Gains details

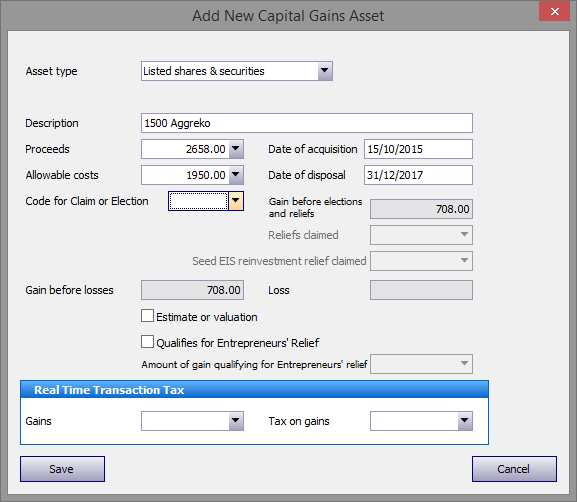

Next select the Asset Type, hit OK and enter the disposal details.

Checking the Claim or election tick box enables manual entries to be made in the Reliefs claimed and Seed EIS relief boxes.

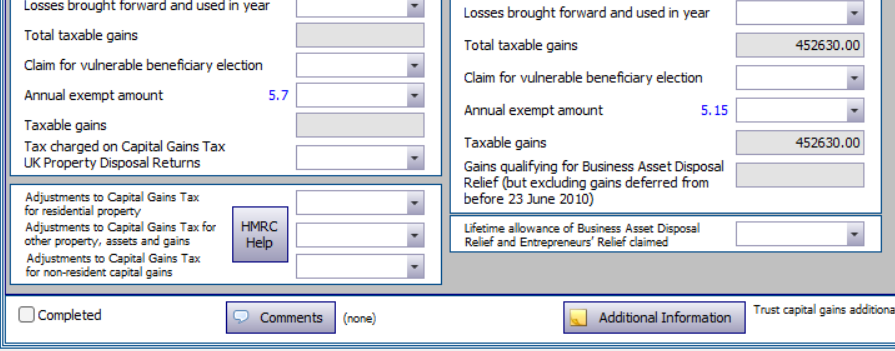

Selecting the election option of BAD (Business Asset Disposal Relief) copies the gain arising on this transaction to the Amount of gain qualifying for Business Asset Disposal Relief box. You will also need to complete the box on the main CGT page for the Lifetime Allowance of Business Asset Disposal relief and Entrepeneurs' Relief - claimed to date.

The program automatically records the number(s) of transactions for each type in boxes 3 and 14 of page CG1, and boxes 23 and 31 of form CG2. However there will be occasions (particularly with disposals of listed shares and securities, perhaps from a stockbrokers printout) where you may wish to enter composite figures rather than many single transactions.

In this case simply enter the total sale proceeds and allowable costs and make a suitable entry in the Description box e.g. "As stockbroker's list/schedule". Next check the Number of disposals tick box and enter the number(s) of transactions in the relevant box(es).

Note:

Complete the calculations by making the appropriate entries in the Summary section. Note that those boxes completed by the program cannot be overwritten.

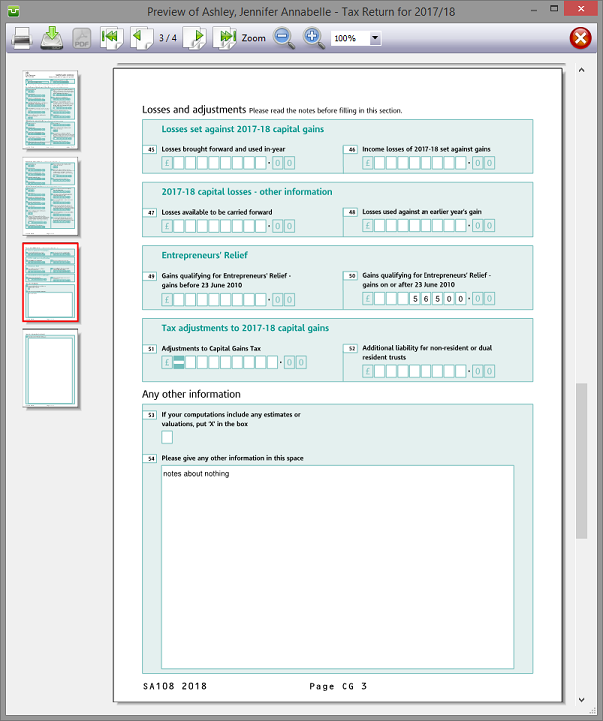

Entries made on the Additional Information area will be printed in box 54 on page CG4 of form sa108. Entries made via Comments are for information only and do not appear on the return or the supplementary pages. The first few words of additional information/comments appear to the right of the relevant boxes.

Finishing

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

| Notes | Helpsheets | ||||

| sa108-notes | Capital Gains | hs275 | Entrepreneurs’ Relief | hs290 | Business Asset Rollover Relief |

| hs276 | Incorporation Relief | hs292 | Land and leases, the valuation of land | ||

| hs278 | Temporary non residents etc. | hs293 | Chattels and Capital Gains Tax | ||

| hs281 | Divorce, dissolution and separation | hs294 | Trust and Capital Gains Tax | ||

| hs282 | Death, personal representatives | hs295 | Relief for gifts and similar transactions | ||

| hs283 | Private Residence Relief | hs296 | Debts and Capital Gains Tax | ||

| hs284 | Shares and Capital Gains Tax | hs297 | Enterprise Investment Scheme | ||

| hs285 | Share reorganisations etc. | hs298 | Venture capital trusts | ||

| hs286 | Negligible value claims | hs299 | Non-resident trusts | ||

| hs287 | Employee share and security schemes | hs301 | Beneficiaries non resident trusts | ||

| hs288 | Partnerships and Capital Gains Tax |

Copyright © 2025 Topup Software Limited All rights reserved.